Table of Contents

What is a Form W-2?

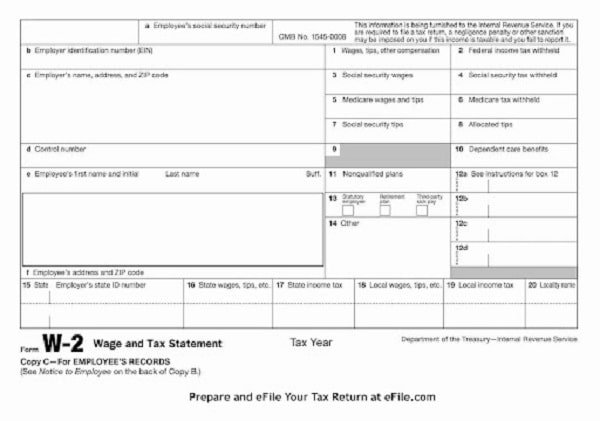

Form W-2, or Wage and Tax Statement—displays an employee’s prior year’s earnings, the percentage of tax deducted by the employer, as well as other details. W-2 forms are used to report all taxable wages received during the calendar year as well as all taxes deferred from those wages. The form functions similarly to an annual report, allowing you to file your personal federal and state income tax returns. Despite the fact that you have agreed to get your W-2 digitally, you may still see your W-2s dating back to 2017.

All employee earnings earned between January 1 and December 31 of the previous year are included on annual W-2s. Wages made after December 26 of this year will be paid in January of the next year and will not be shown on the current W-2.

Who receives Form W-2?

The W-2 tax form is only given to full-time workers of a corporation. These employees are on the industry’s paycheck; they get paystubs regularly and are not required to provide their employer’s invoices to be paid. Workers may check their gross and net salary. Gross pay includes the necessary perks and taxes that businesses must pay for their full-time employees, whereas net pay is the sum of funding an employee receives.

What happens if you don’t receive your Form W-2? If your W-2 for the current year hasn’t come to the mailbox, contact your employer for a copy and double-check the address. You may also be instructed by the firm on how to receive your W-2 from the HR department. You must provide when you worked as well as an estimate of how much you were paid.

What documentation is required for the W-2?

There are six copies of Form W-2:

- Copy A: sent by the employer to the Social Security Administration, or SSA

- Copy B: the employee submits a tax return to the IRS.

- Copy C: the employee should keep their records.

- Copy D: the employer maintains a copy for its records.

- Copy 1: if requested, the employer submits with the tax authorities.

- Copy 2: if requested, the employee files with tax authorities.

How Much Would You Have to Pay to Get a W-2?

In general, if you earned at least $600 in a given year, you will receive a W-2 from your company. You will also receive a W-2 if your employer withheld taxes on your earnings. 3 It is important to note that if you were a contracted individual i.e among remote workers rather than an employee—you would most likely receive 1099 instead of a W-2.

Form W-2 filing details

The W-2 form contains identity information for both the employer and the employee, such as the employee’s social security number or taxpayer-identification number (TIN) and the employer’s identification number (EIN). It also contains personal information about the employee, and also income information such as taxable earnings, gratuities, bonuses, tax withheld from the employee’s salary, and dependent and deducting details.

Box a: Employee’s social security number (SSN)

The social security number is used to cross-check the data received from the City with the amounts displayed on your tax returns. Your SSN is used by the Social Security Administration to record your earnings for future social

Box b: Employer identification number (EIN)

The IRS has issued you an Employer Identification Number.

Box c: Employer’s name, address, and ZIP code

There are the details provided by the employer for tax reporting reasons.

Box d: Control number

This box displays the agency’s paycheck number and paycheck distribution code to help in W-2 distribution.

Boxes e, f: Employee’s Full name, signatures, and complete address

This box displays your name and address as they appear in the City’s Payroll Management System.

If your name changes, the SSA will not be able to publish your wages until your social security records are updated. Call 1-800-772-1213 to record a name change to the Social Security Administration.

Box 1: Wages, tips, other compensation

The taxable wages are the gross wages and other compensation received from you throughout the year, including the taxable fringe benefits which are Union Legal Service, Motor Vehicle Use Fringe Advantage, Parking Surcharge Advantage, Payment for Health Buy-Out Waiver, Administrative Fee for Commuter Benefits, Premiums for Domestic Partner Health Insurance, Reimbursement for Health and Fitness, Program for Wellness

Box 2: Withheld federal income tax

This is the total amount of federal income tax deducted from your paycheck throughout the fiscal year.

Box 3: Wages from Social Security

This is the entire amount of earnings earned that is subject to social security. For health insurance payments, Commuter Benefits, and other flexible spending program contributions, Social Security salaries are decreased. Deferred compensation and pension contributions do not affect social security wages.

Box 4: Withheld Social Security tax

This is the total amount of social security tax deducted from the salary over the year.

Box 5: Wages and tips for Medicare

Wages subject to Medicare tax are the same as those subject to social security tax in Box 3, with the exception that there is no wage base limit for Medicare tax.

Box 6: Withheld Medicare tax

This is the total amount of Medicare tax taken from your paycheck for the fiscal year. Most employees pay a Healthcare fee of 1.45 percent of their insured salaries.

Box 10: Benefits for dependents

These are payroll deduction payments to the Dependent Care Assistance Program.

Box 11: Nonqualified plans

This box does not apply to NYC W-2s and will be left blank.

Box 12: Tax-advantaged annuities (TDA)

The majority of TDA contributions are not taxable. Because of the TDA payments, taxable earnings (Box 1), as well as state and city wages (Boxes 16 and 18), are decreased. On the lesser reported wage amount, then you submit your federal, state, and local tax returns.

Box 13: Retirement strategy

Indicates whether or not an employee is eligible to participate in a pension plan.

Important note:

Do not send a copy of the red version of the W-2 form from the IRS website to the SSA. The form cannot be scanned and will thus be rejected; you may even be punished. Alternatively, obtain paper forms from the IRS and send them in, or submit them electronically with the Social Security Administration via its web services site.