Is Gcash Shutting Down in 2024

GCash is not shutting down; the temporary removal from Google Play Store is for Android app updates. Users can stay informed through official social media channels. Services remain accessible and secure.

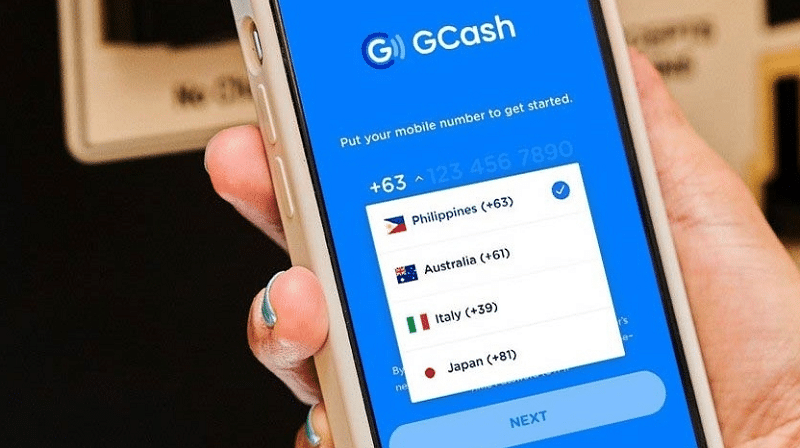

About GCash

GCash is a widely-used mobile payments service in the Philippines, launched in 2004 by Globe Telecom. Initially, an SMS-based money transfer service, GCash evolved with the introduction of a mobile app in 2012, transitioning to a digital cashless system. It played a crucial role in providing financial access to Filipinos without formal banking services.

As of May 2023, GCash boasts 81 million active users and 2.5 million sellers and merchants across the country. Owned by Mynt, a joint venture between Ant Group, Ayala Corporation, and Globe Telecom, GCash facilitates various financial transactions, including QR-based payments, mobile and gaming credit purchases, online checkout, and bills payment.

GCash has faced challenges, including service interruptions from 2017 to 2020 and an unauthorized transactions incident in May 2023. Despite these challenges, it remains influential, with partnerships and innovations, such as GCash Jr. for users aged 7 to 17, contributing to its widespread use. The service continues to be a significant player in the Philippines’ financial landscape, offering convenience and accessibility to millions of users.

Gcash History

GCash, launched in October 2004, started as an SMS-based money transfer service by Globe Telecom, aiming to serve Filipinos without access to formal banking. It allowed users to convert cash to e-money through outlets like sari-sari stores. In 2012, GCash evolved, launching its mobile app for a digital cashless system. It became a popular payment method for retail and events.

From 2013 to 2020, GCash introduced new features like QR-based payments, mobile and gaming credits, online checkout, and bills payment. Partnerships, such as with CIMB Bank for GSave, expanded its services. In 2021, GCredit moved to CIMB Bank, and GCash Padala was revived for remittances.

GCash’s parent company, Mynt, became the Philippines’ first double unicorn in 2021, raising $300M at a $2B valuation. In 2022, GCash Jr. targeted users aged 7 to 17 for financial education.

Despite success, GCash faced challenges, including service interruptions from 2017 to 2020. In May 2023, it experienced unauthorized transactions, prompting a temporary shutdown. Investigations revealed a security breach from phishing attacks, impacting vulnerable users.

Gcash Issues

GCash has faced various issues throughout its history. During its hypergrowth stage from 2017 to 2020, the service encountered multiple service interruptions lasting between one and eight hours, leading to transaction errors and user frustrations.

One significant challenge involved unauthorized transactions in May 2023. Hundreds of users reported missing funds from unauthorized bank transfers, prompting GCash to temporarily shut down its app. Despite denying a hacking incident, GCash faced criticism for not providing comprehensive investigation findings. Around 300 victims formed a group chat alleging hacking, but GCash maintained that all funds were secure.

In response to fraud and scams, GCash launched “Double Safe” in 2023, requiring facial identification for added security. The National Privacy Commission confirmed a security breach resulting from phishing attacks and conducted an independent assessment. Despite adjusting the balances of affected users and resuming operations, GCash faced criticism for its handling of the situation, leading to calls for a congressional probe.

These challenges highlight the importance of ongoing efforts to enhance user security and address potential vulnerabilities.

Why Was GCash Removed From the Google Play Store?

GCash was temporarily removed from the Google Play Store due to updates being made to its Android app. This removal was specific to the Google Play Store, and GCash assured users that their services remained accessible through other platforms like Apple’s iTunes App Store and Huawei’s AppGallery.

The decision to take GCash off the Google Play Store was part of the process to implement improvements and new features for Android users. GCash emphasized that the removal was not a shutdown but a temporary measure to enhance the app’s functionality. The company is actively working with Google to make the app available on the Play Store again.

While the app was not visible on the Google Play Store during this period, users were encouraged to stay informed about updates through GCash’s official social media accounts. GCash also warned against downloading the app from untrusted sources and reiterated that users’ accounts and funds remained safe and secure during this maintenance phase. Overall, the removal was a strategic move to ensure the continued improvement and reliability of the GCash app on Android devices.

How Many Users Does GCash Have?

As of May 2023, GCash, a popular mobile payments service in the Philippines, claims to have a substantial user base with 81 million active users. Additionally, it boasts a network of 2.5 million sellers and merchants across the country. GCash has become widely used due to its convenience and accessibility, allowing users to perform various financial transactions through its platform.

The service was initially launched in 2004 by Globe Telecom as an SMS-based money transfer service. Over time, it evolved with the introduction of a mobile application in 2012, shifting towards a digital cashless system. GCash is owned by Mynt, a joint venture involving Ant Group, Ayala Corporation, and Globe Telecom.

Despite facing challenges such as service interruptions and unauthorized transactions in its history, GCash continues to play a significant role in providing financial services to Filipinos, especially those without access to formal banking. The large user base indicates the widespread adoption and reliance on GCash for diverse financial activities in the Philippines.

What Features Does GCash Offer?

GCash offers a variety of features, making it a versatile and widely-used mobile payments service in the Philippines. Users can perform cashless transactions through the platform, including QR-based payments, allowing for convenient and secure in-store purchases. Additionally, GCash facilitates mobile and gaming credit purchases, enabling users to top up their accounts and make digital purchases.

The service supports online checkout, making it easy for users to make payments for goods and services on various online platforms. GCash also allows for barcode cash-in, where users can convert physical cash into electronic money by scanning barcodes at authorized outlets.

GCash simplifies bills payment by providing a platform for users to settle utility bills, loans, and other financial obligations. It further supports InstaPay, enabling interbank transfers for added flexibility.

In 2021, GCash introduced GSave, a high-yield savings account, in partnership with CIMB Bank Philippines. GCredit, a revolving mobile credit line, was also launched, initially powered by Fuse Lending. The platform’s continuous innovation and partnerships contribute to its widespread use and popularity among Filipinos for various financial transactions.

Is GCash Shutting Down In 2024 – FAQs

- Is GCash shutting down in 2024?

No, GCash is not shutting down in 2024. The temporary removal from the Google Play Store was due to updates, and GCash remains accessible through other platforms. - Why was GCash removed from the Google Play Store?

GCash was temporarily removed for updates on its Android app. The issue is specific to the Google Play Store, and GCash is working with Google to restore availability. - Who owns GCash?

GCash is owned by Mynt, a joint venture between Ant Group, Ayala Corporation, and Globe Telecom. - What features does GCash offer?

GCash offers various features, including QR-based payments, mobile and gaming credit purchases, online checkout, barcode cash-in, bills payment, and support for InstaPay. - Has GCash faced any issues or interruptions?

Yes, GCash experienced service interruptions from 2017 to 2020, and there have been reports of fraud and scams targeting users, leading to enhanced security measures. Visit – NewsPSP | NewsDekha