Table of Contents

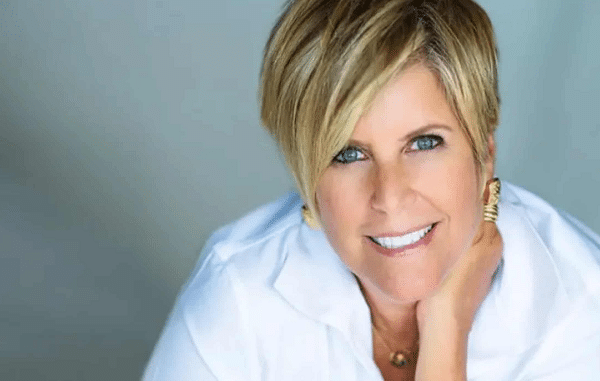

Are you ready to learn how to think like a millionaire? Suze Orman, the renowned financial guru and best-selling author, has built her $75 million net worth through years of hard work, dedication, and a unique mindset that sets her apart from others. In this blog post, we’ll explore the secrets behind Suze’s success and how you can adopt her millionaire mindset to achieve your own financial goals. Get ready to transform your thoughts about wealth creation and discover the power of a positive outlook on finances!

Introduction to Suze Orman

Suze Orman is a world-renowned financial expert and best-selling author who has helped millions of people take control of their finances. She is also a very successful businesswoman, having built a multimillion-dollar net worth through her various businesses and investments.

In this article, we’ll take a look at some of the key things that Suze Orman has said about building wealth and achieving financial success. We’ll also learn some valuable lessons from her own journey to becoming a self-made millionaire.

So, if you’re ready to start learning how to build your own wealth and achieve financial independence, then let’s get started with our introduction to Suze Orman!

The Philosophy Behind Suze Orman’s Millionaire Mindset

For Suze Orman, money is all about freedom.

Orman was born in 1951 and grew up in a middle-class Jewish family in Chicago. Her parents instilled in her a strong work ethic and the belief that money could be used to achieve financial independence.

After graduating from the University of Illinois with a degree in social work, Orman began her career as a financial advisor. She soon realized that she had a knack for helping people make smart decisions with their money.

In 1983, Orman wrote her first book, “Women & Money.” The book was an instant bestseller, and it helped launch Orman’s career as one of America’s most popular personal finance experts.

Orman is known for her no-nonsense approach to money management. She believes that people should take control of their finances and make smart choices with their money.

Orman’s philosophy is based on the belief that money should be used to achieve financial independence. This means having enough money to live comfortably without having to worry about bills or debt. For Orman, financial independence is the ultimate goal.

Money Management Tips from Suze Orman

1. Money Management Tips from Suze Orman:

Suze Orman is a financial expert and bestselling author who knows a thing or two about money management. Here are some of her top tips for building wealth and achieving financial security:

-Save, save, save: One of the key things to remember when it comes to money management is that you need to be saving as much as possible. Try to put away at least 10% of your income into savings so that you have a cushion in case of emergencies.

-Invest in yourself: Another important tip is to invest in yourself. This means taking the time to learn about personal finance and investing so that you can make smart decisions with your money. It can also mean investing in your education or career so that you can earn more money down the road.

-Live below your means: One of the best ways to stay out of debt and build wealth is to live below your means. This means spending less than you earn and being mindful of your expenses. When you live below your means, you’ll have more money available to save and invest for the future.

-Give back: Finally, don’t forget to give back. Giving back doesn’t just feel good – it can also help you reduce your taxes and build goodwill with others. Consider donating to charities or causes that are important to you

Budgeting and Investing Strategies According to Suze Orman

If you want to build wealth, you need to start by budgeting and investing wisely. Here are some tips from Suze Orman on how to do just that:

1. Make a budget and stick to it.

2. Invest in yourself first.

3. Pay off debt as quickly as possible.

4. Invest in quality over quantity.

5. Live below your means.

6. Have an emergency fund of at least six months of living expenses saved up.

7. Invest for the long term – don’t try to time the market.

How to Live Below Your Means According to Suze Orman

In order to live below your means, you need to be aware of your spending patterns and make adjustments accordingly. One way to do this is to track your spending for a month in order to get an accurate picture of where your money goes. Once you know where your money is going, you can make changes in order to save money.

Some ways to save money include:

1. eliminating unnecessary expenses

2. eating out less often

3. cutting back on shopping trips

4. taking advantage of sales and discounts

5. comparison shopping

6. using coupons

7. buying in bulk

8. avoiding impulse purchases

Building Wealth through Strategic Giving

Strategic giving is one of the smartest things you can do with your money—both in terms of building your own wealth and making a positive impact on the world. And there’s no better teacher on the subject than Suze Orman.

In her book The Millionaire Mindset, Orman lays out her philosophy on giving: “You have to give back. It’s not an option; it’s an imperative. The more you give, the more you get… When you help others, you are not only making their lives better; you are making your own life better as well.”

Orman doesn’t just talk the talk; she walks the walk, too. She is a passionate philanthropist, donating both her time and her money to numerous causes close to her heart. And she encourages her readers to do the same.

Giving doesn’t have to be complicated or expensive; even small acts of kindness can make a big difference in someone’s life. But if you want to make a real impact with your giving, Orman recommends taking a strategic approach.

Think about what issues or causes are most important to you and where your donations can have the biggest impact. Then research charities that align with your values and pick one or two (or more) that you feel good about supporting financially.

Finally, don’t forget to consider how your gifts can help you reduce

How to Use Financial Technology According to Suze Orman

In order to build and maintain her $ million net worth, Suze Orman relies on financial technology. She uses a combination of online tools and software to manage her finances, stay on budget, and invest for the future.

Orman recommends using online banking and budgeting tools to keep track of your spending and income. This can help you identify areas where you may be overspending or could save money. Once you have a handle on your spending, you can start setting aside money each month to save and invest.

Investing is one of the most important things you can do for your financial future. But it can be confusing and overwhelming, especially if you’re just getting started. Orman recommends using an online investment platform like Betterment or Wealthfront to get started. These platforms offer guidance and advice on how to best invest your money based on your goals.

No matter what stage you are at in your financial journey, Orman says it’s important to stay focused on your goals and always keep learning. Financial education is key to building wealth over time. There are many resources available online and offline to help you learn more about personal finance, investing, and budgeting. The more you know, the better equipped you’ll be to make smart financial decisions that will help you reach your goals.

The Power of the Mindset: Life Lessons from Suze Orman

We all know that having a positive mindset is important in life. But did you know that your mindset can actually be the key to becoming a millionaire? That’s what renowned financial expert Suze Orman says, anyway.

Orman has become one of the most successful financial advisors in the world by helping people change their relationship with money. And she believes that having the right mindset is essential to building wealth.

Here are some of Orman’s top tips for building a millionaire mindset:

1. Think long-term. When it comes to building wealth, patience is key. Orman says that you need to think about your financial goals 10, 20, even 30 years down the line. This will help you make smart decisions today that will pay off in the future.

2. Invest in yourself. One of the best investments you can make is in yourself. That means taking care of your health, educating yourself, and developing useful skills. The better you take care of yourself, the more likely you are to be successful and earn a high income.

3. Live below your means. One of the biggest mistakes people make is spending everything they earn – or even more than they earn! If you want to build wealth, you need to live below your means and invest the difference wisely.

4. Make saving a priority. Another mistake people make is not prioritizing saving for their future. Orman recommends putting aside at least 10% of your